'Mobile Deposit Questions: How Does Mobile Deposit Work?' 'Consumer Account Fee and Information Schedule.' Bank of America. 'ATM & ATM FeesFAQs: Making Deposits at the ATM: How Many Checks Can I Deposit at One Time?' Dec 23, 2020 The Wells Fargo mobile check deposit limit for all customers is $2,500 per day and $5,000 over a 30-day period.

- Wells Fargo Mobile Deposit Hold

- Wells Fargo Mobile Deposit Scam

- Wells Fargo Mobile Deposit Endorsement

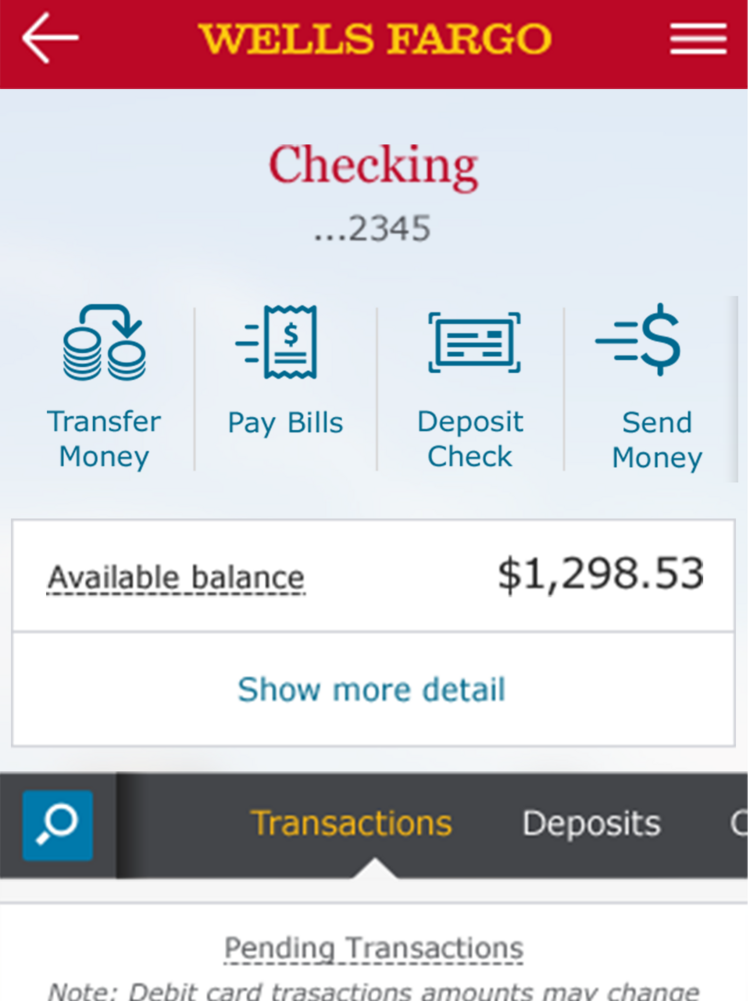

Managing your savings and checking accounts can be a lot easier these days thanks to innovations like online and mobile banking. One of the newest tools that banks are rolling out is mobile deposit, which allows you to add money to your account by taking a picture of it with your smartphone.

While mobile deposit can be convenient, it’s not without certain drawbacks. SmartAsset takes a brief look at the potential disadvantages of using mobile deposit.

1. It Can Take Longer for Funds to Hit Your Account

Generally, when you deposit a check at the drive-thru or teller window, you can expect to see at least some of the money credited to your account that same day. When you deposit a check from your mobile device, it may take a little longer for your funds to become available based on what time of day the deposit was made. For example, mobile check deposits made after 6 p.m. Pacific time on business days to at least one major bank can’t be used until two business days later.

Aside from the processing cutoff times, there are a few other things that can potentially affect how long it takes for the money to show up in your account. If you’re a new customer, you’ve racked up multiple overdraft charges, the deposit is for more than a certain dollar amount (say $50,000) or the bank believes that the check won’t be honored, you may have to wait as long as a week for it to be verified before the deposit clears.

2. Some Banks Limit How Much You Can Deposit

Mobile deposit’s usefulness may only go so far if you’ve got multiple checks you need to deposit each month. Some banks require you to make your deposits at an ATM or in-person at a branch once you reach a certain number of transactions or a specific dollar amount.

Each bank sets its own policy on how much you can deposit from your mobile device and in some cases, it depends on how long you’ve been a customer. SunTrust, for instance, limits mobile check deposits to $1,000 per check and $3,000 per month if your account has been open for six months or less. At Citibank, the limit for new account holders is $500 per day or $1,500 per month.

3. You May Be Charged a Fee

While most banks offer mobile deposit services at no charge, others impose a small fee. At least one major bank charges a fee, currently set at $0.50 per transaction. You may have to pay a fee if you have an account at a smaller community bank or credit union, so it’s a good idea to read over your account agreement before you begin using mobile deposit. While it doesn’t seem like a lot, you could easily be nickel and diming yourself if you use mobile deposit on a regular basis.

4. Security Is Not 100% Guaranteed

Banks are more cautious than ever these days when it comes to protecting their customers’ information but there’s always the possibility that a cyber thief could get his or her hands on your account details if you use mobile deposit.

To minimize the risk, it’s a good idea to avoid storing your username or password in your phone’s app and only log in to mobile banking services using a secure connection. Something as simple as putting a lock code on your smartphone can keep a random stranger from accessing your account if your phone gets lost or stolen.

Final Word

If you don’t have time to stand in line at the bank, mobile deposit can be an efficient way to manage your money. Just be sure you’re clear on what your bank’s policies are before you start snapping away with your phone.

Update: Have more financial questions? SmartAsset can help. So many people reached out to us looking for tax and long-term financial planning help, we started our own matching service to help you find a financial advisor. The SmartAdvisor matching tool can help you find a person to work with to meet your needs. First you’ll answer a series of questions about your situation and goals. Then the program will narrow down your options from thousands of advisors to up to three fiduciaries who suit your needs. You can then read their profiles to learn more about them, interview them on the phone or in person and choose who to work with in the future. This allows you to find a good fit while the program does much of the hard work for you.

Photo credit: flickr

Wells Fargo Mobile Deposit Hold

Insurer and financial-services provider United Services Automobile Association on Wednesday asked a federal court to dismiss a request by mobile remote deposit capture technology developer Mitek Systems Inc. for a declaratory judgment that Mitek’s technology does not infringe on four USAA patents.

San Antonio, Texas-based USAA’s dismissal request came less than a week after a jury awarded the company $102 million in damages from Wells Fargo & Co. at the end of a trial in which it determined Wells had infringed on two of USAA’s mobile-capture patents. That award, made in U.S. District Court in Marshall, Texas, came about two months after USAA won $200 million from Wells in a separate patent-infringement trial involving two other mobile-capture patents.

Although it was not a party to either of the USAA-Wells Fargo lawsuits, the litigation was of great concern to San Diego-based Mitek, the leading vendor in the mobile-capture industry, with its software used by thousands of financial institutions. Both USAA and Mitek are mobile-capture pioneers, with Mitek rolling out its first such software product in 2008. USAA developed mobile-capture software to serve its widely dispersed military customer base. Both companies had fought in court before over mobile-capture patents, but settled in 2014.

Wells Fargo Mobile Deposit Scam

Citing its early development of mobile-capture software, USAA indicated about two years ago that it wanted financial institutions to license its technology. USAA’s first big target was Wells, which it sued in June 2018 for alleged infringement of several of its patents. That case, also heard in the Marshall federal court, resulted in the $200 million damages award.

In August 2018, USAA filed its second lawsuit against Wells, resulting in the Jan. 10 verdict.

Noting its previous legal tussles with USAA and the widespread use of its software, Mitek named USAA as the defendant in a suit it filed Nov. 1 in U.S. District Court in San Francisco. Mitek said the purpose of the suit was to get a declaratory judgment that its technology does not infringe on four USAA patents.

In its dismissal motion, USAA accuses Mitek of “an extreme attempt at forum shopping,” saying the San Francisco federal court does not have so-called “subject-matter jurisdiction.” Plus, San Diego-based Mitek does not have any “particular connection” to the court’s jurisdiction, USAA claims. In the alternative, if it doesn’t dismiss the case, USAA asked the court to transfer it to the federal court in Marshall, Texas, where the underlying issues already have been extensively litigated.

It’s unclear when the court will rule on the motion. A Mitek spokesperson did not respond to a Digital Transactions News request for comment.

Meanwhile, San Francisco-based Wall Fargo says it disagrees with the latest jury verdict, but it hasn’t stated what it will do next.

“We believe this is an industry issue involving numerous other banks that license remote mobile deposit technology from the same vendor, not USAA,” a spokesperson for San Francisco-based Wells says by email. “We are considering our options based on the verdict and trial. Wells Fargo has been and continues to be a leader in enabling seamless payments and mobile-banking experiences, and this ruling has no impact on our customers’ ability to remotely deposit checks or the company’s work to provide innovative tools and technologies to our customers.”

Nathan McKinley, USAA vice president of corporate development, said in a statement that “this verdict further validates our position that we created mobile deposit capture technology. Wells Fargo, and the rest of the banking industry, has benefited from our technology and we look forward to working with banks to create reasonable and mutually beneficial license agreements. Our goal has always been to be reasonably compensated for the investment in mobile banking innovation we have made on behalf of our members and the military community.”

Wells Fargo Mobile Deposit Endorsement

A USAA spokesperson tells Digital Transactions News the company has no comment beyond McKinley’s statement.